45 irs gift card scam

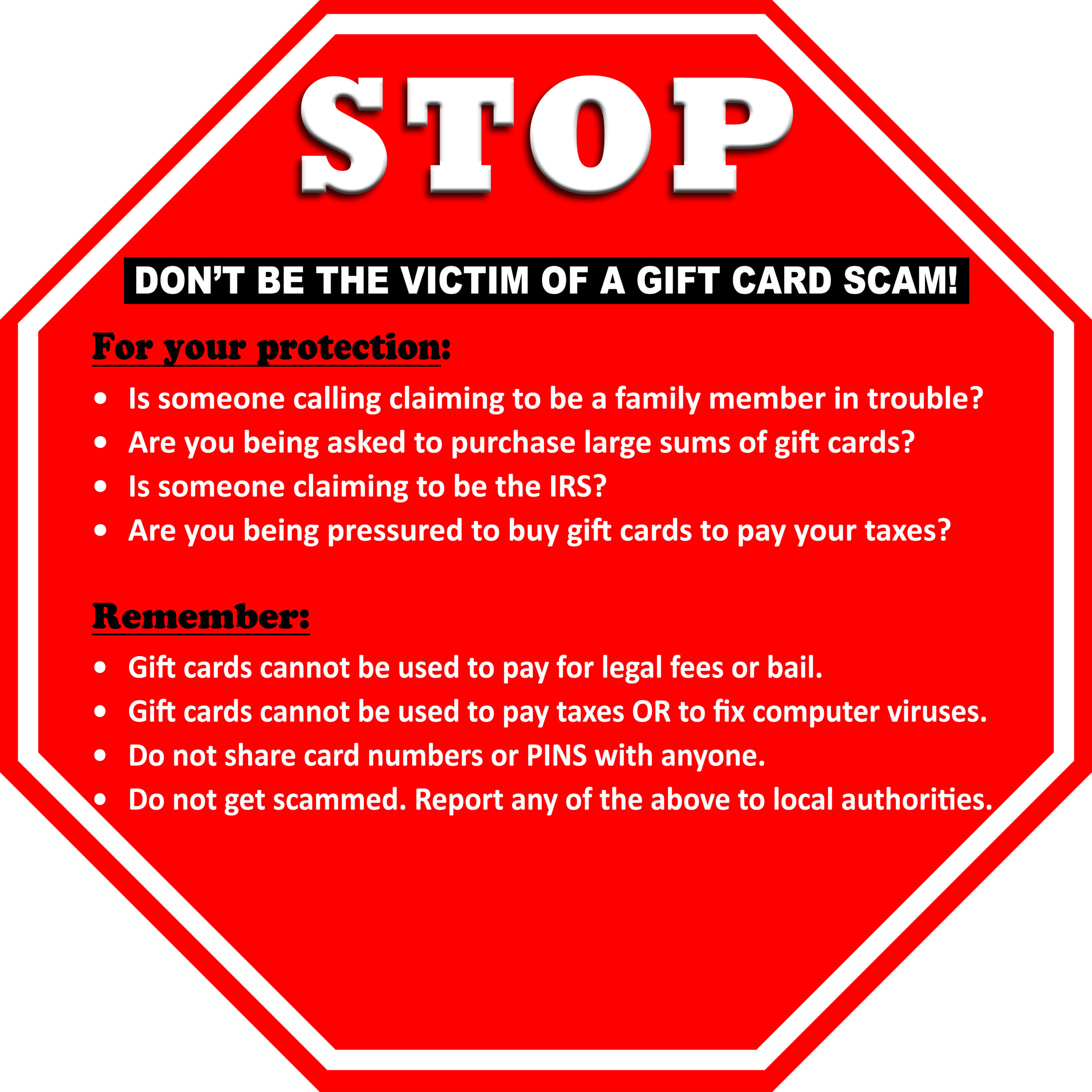

Search for Tax Exempt Organizations | Internal Revenue Service Organizations are listed under the legal name or a “doing business as” name that are on file with the IRS. Common or popular names of an organizations are not on file. In the Publication 78 data, “doing business as” names of organizations are not listed. Note: If you are not getting the result you want, try sorting by city, state or zip. Reminder to all taxpayers: Gift cards are not used to ... - IRS tax forms The IRS reminds taxpayers gift cards are for gifts, not for making tax payments. Here's how this scam usually happens: The most common way scammers request gift cards is over the phone through a government impersonation scam. However, they will also request gift cards by sending a text message, email or through social media.

About Gift Card Scams - Official Apple Support If you have additional questions, or if you've been a victim of a scam involving Apple Gift Cards, App Store & iTunes Gift Cards or Apple Store Gift Cards, you can call Apple at 800-275-2273 (U.S.) and say "gift cards" when prompted, or contact Apple Support online. FTC: Scammers Increasingly Demand Payment by Gift Card.

Irs gift card scam

Publication 561 (01/2022), Determining the Value of Donated … Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Gift Card Scams: What They Are and How to Avoid Them In one common gift card scam, cybercriminals place a call or send a text message to the victim, claim to be a government agency or authority figure (such as the IRS, Social Security, the FBI or a ... It’s the IRS calling…or is it? | Consumer Advice Mar 12, 2015 · Got a call and voice mail saying the IRS was filing a Lawsuit which is an obvious scam. The number they used this time was 509-252-0823 out of Spokane, WA. The IRS doesn't operate this way and will never call you about filing a lawsuit. Everything I have dealt with the IRS was first through the mail, never have they called me first.

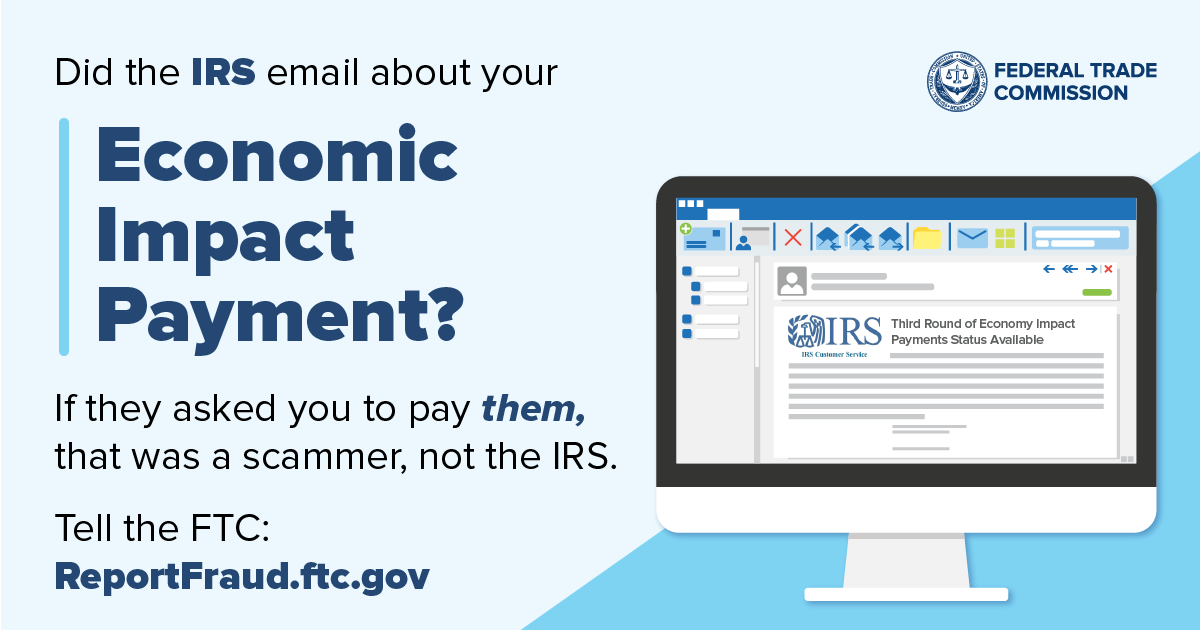

Irs gift card scam. Gift Card Scams | Consumer Advice 19.08.2022 · Learn about iTunes gift card scams and how to report them. Steam. Report the gift card scam to Steam through Steam Support. Keep the Steam card itself and your receipt for the Steam card. Learn about Steam gift card scams. Call Target GiftCard Services at 1 (800) 544-2943 and follow the instructions provided. MoneyPak. Submit a fraud claim to ... U.S. News | Latest National News, Videos & Photos - ABC News ... Nov 22, 2022 · Get the latest breaking news across the U.S. on ABCNews.com Tax Scams / Consumer Alerts | Internal Revenue Service - IRS … Nov 21, 2022 · IRS urges all taxpayers caution before paying unexpected tax bills. Please see: IRS Alerts Taxpayers with Limited English Proficiency of Ongoing Phone Scams. Note that the IRS doesn't: Call to demand immediate payment using a specific payment method such as a prepaid debit card, gift card or wire transfer. Common Scams and Frauds | USAGov Nov 10, 2022 · Learn how to recognize and report a COVID vaccine scam and other types of coronavirus scams. Common Coronavirus Scams. Scammers change their methods frequently. Current coronavirus scams include: Identity theft when people post a photo of their vaccination card on social media - Don't post a photo of your vaccination card online. Scammers can ...

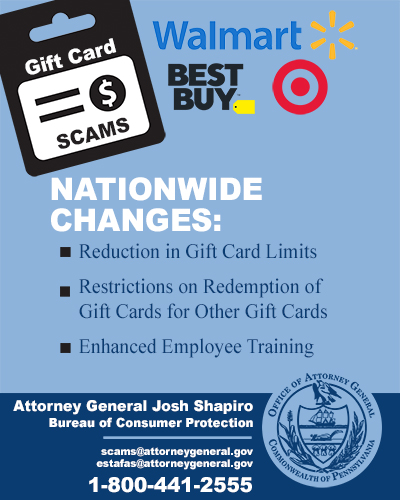

Gift Card Scams | Consumer Advice Scammers are tricking more people into buying gift cards. Cristina Miranda. December 8, 2021. According to the newest Data Spotlight, 40,000 people reported losing a whopping $148 million in gift cards to scammers during the first nine months of 2021. Those are staggering numbers which have. Warning about IRS phishing scams - The US Sun The IRS warned against phishing scams during the holidays "This year, fraud scams related to COVID-19, Economic Impact Payments and other tax law changes are common," the agency warned. In an effort to keep Americans safe, the IRS shared guidelines for avoiding scams and phishing attempts this holiday season. Be vigilant about gift card scams Publication 535 (2021), Business Expenses - IRS tax forms Go to IRS.gov/OrderForms to order current forms, instructions, and publications; call 800-829-3676 to order prior-year forms and instructions. The IRS will process your order for forms and publications as soon as possible. Don’t resubmit requests you've already sent us. You can get forms and publications faster online. IRS Gift Card Scam - LinkedIn The IRS reminds taxpayers gift cards are for gifts, not for making tax payments. ... been targeted by a scammer should contact the Treasury Inspector General for Tax Administration to report a ...

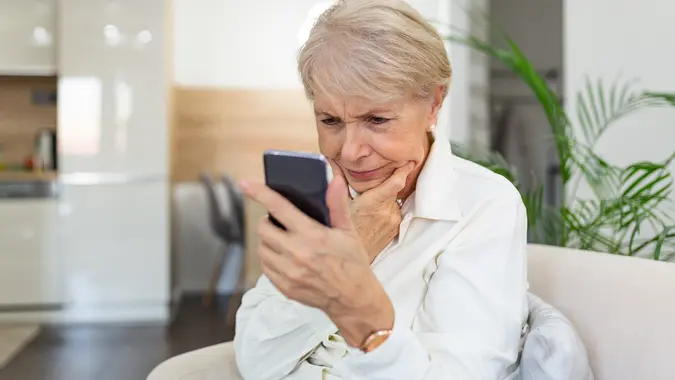

Publication 463 (2021), Travel, Gift, and Car Expenses - IRS tax … They paid $80 for each gift basket, or $240 total. Three of Local Company's executives took the gift baskets home for their families' use. Bob and Jan have no independent business relationship with any of the executives' other family members. They can deduct a total of $75 ($25 limit × 3) for the gift baskets. Publication 334 (2021), Tax Guide for Small Business If the employee's name is not correct as shown on the card, the employee should request a new card from the SSA. This may occur if the employee's name was changed due to marriage or divorce. Form W-4, Employee's Withholding Allowance Certificate, is completed by each employee so the correct federal income tax can be withheld from their pay. IRS Impersonation Scam Update - United States Secretary of the Treasury IRS Impersonation Scam Update. As of June 6, 2018, TIGTA has received additional information that callers impersonating Internal Revenue Service (IRS) or Treasury Department employees are demanding payments for alleged outstanding tax debts not only on iTunes cards and other reloadable gift cards, but now also on Google Play Gift Cards. Gift Card Scams that Target Seniors | New Cyber Senior The most prevalent scam targeting seniors involves gift cards. In 2019, more than $74 million was stolen using gift card fraud. Additionally, one-third of all fraud cases reported to the Federal Trade Commission (FTC) will involve gift cards. Gift card fraud may seem odd, but they are virtually untraceable, and unlike credit cards, once used ...

Taxpayers should watch out for gift card scam - IRS tax forms Gift card scams are on the rise. In fact, there are many reports of taxpayers being asked to pay a fake tax bill through the purchase of gift cards. ... Contact the Treasury Inspector General for Tax Administration to report a phone scam. Use their IRS Impersonation Scam Reporting webpage. They can also call 800-366-4484. Report phone scams to ...

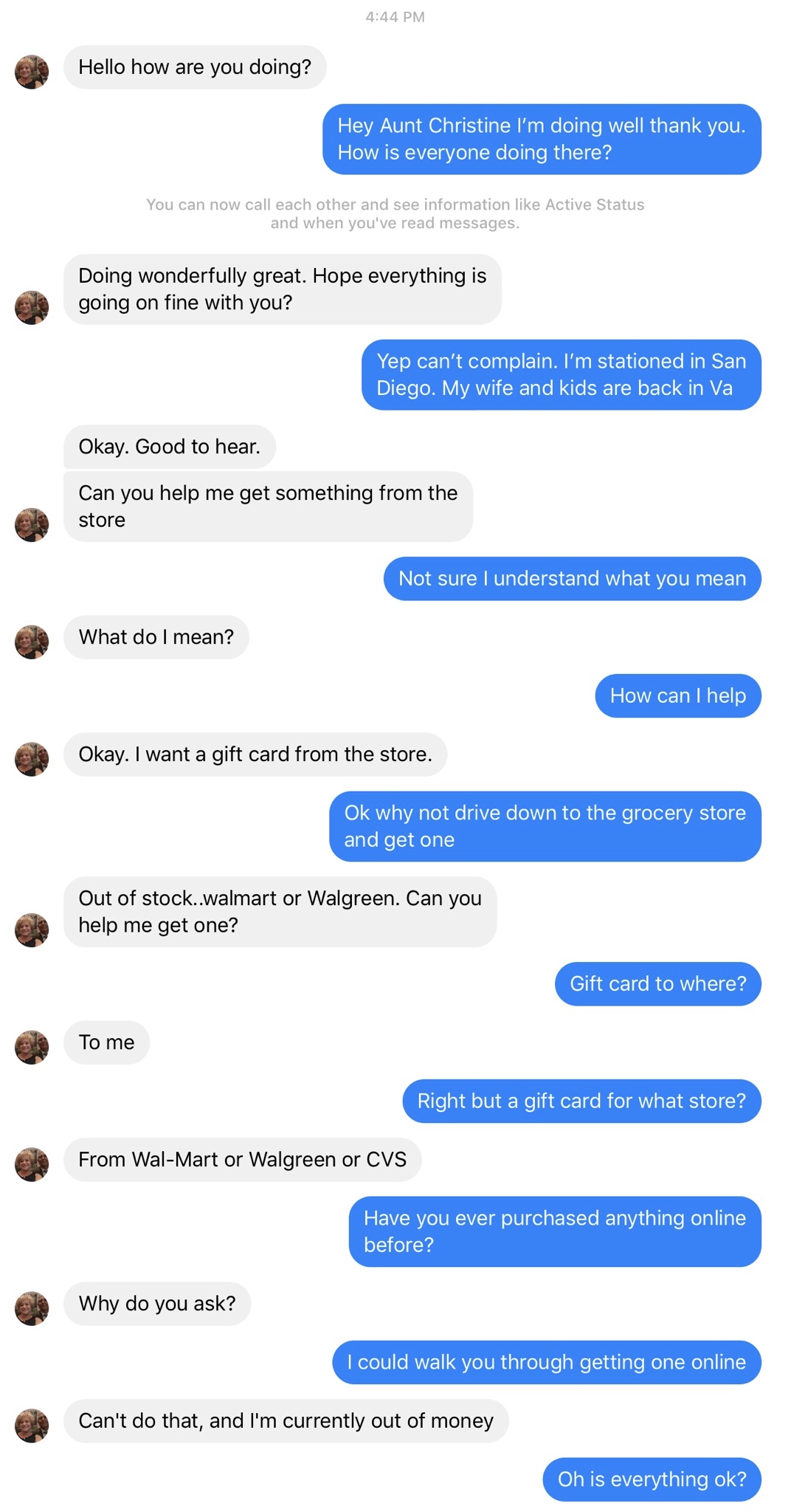

Beware of Gift Card Scams | IRS Gift Card Scam | Utility Support Scam The IRS gift card scam. In this scam, a target receives a threatening message that's allegedly from the IRS and claiming they are at risk of arrest for tax evasion if they do not pay up immediately. However, they insist that payment can only be made in the form of a gift card. Often, the scammer will ask specifically for an iTunes gift card ...

Avoid scams: Know the facts on how the IRS contacts taxpayers Here are the facts about this program: The IRS will send a letter to the taxpayer letting them know the IRS has turned their case over to one of the four PCAs. The PCA will also send the taxpayer a letter confirming assignment of the taxpayer's account to the agency. The IRS will assign a taxpayer's account to only one of these agencies ...

What to do if you’re a victim of a Google Play gift card scam If you’re a victim of a gift card scam, report the scam to your local police department. You can also report the scam to the Federal Trade Commission. Next, report the gift card scam to Google. If you report the scam, it may help you and others from similar suspicious activities in the future.

Publication 526 (2021), Charitable Contributions - IRS tax forms Go to IRS.gov/OrderForms to order current forms, instructions, and publications; call 800-829-3676 to order prior-year forms and instructions. The IRS will process your order for forms and publications as soon as possible. Don’t resubmit requests you’ve already sent us. You can get forms and publications faster online.

7 types of gift card scams: How to spot them and avoid them And, finally, the IRS will never request that you pay owed taxes with a gift card. Scam 2: Beware the bots. Gift card scammers often turn to bots — software applications that perform automated tasks online — to drain the gift card balances of unsuspecting consumers. Scammers might use a bot called GiftGhostBot to scour retailers' online ...

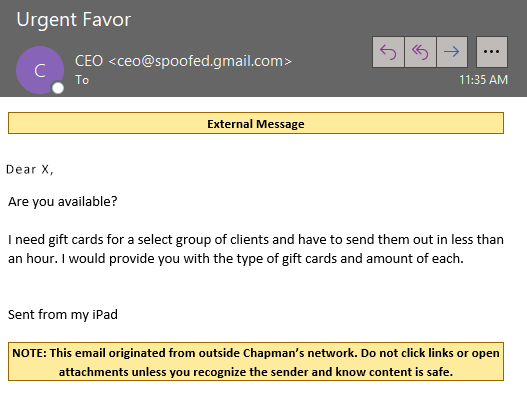

Holiday scam reminder: Gift cards are never used to make tax payments Español. IRS Tax Tip 2021-178, December 2, 2021. This holiday season the IRS reminds taxpayers, the agency won't ask for or accept gift cards as payment for a tax bill. However, that doesn't stop scammers from targeting taxpayers by asking them to pay a fake tax bill with gift cards. They may also use a compromised email account to send emails ...

Gift Card Scam - YouTube video text script - IRS tax forms Scammers use gift cards to steal your money. The scammer may call you impersonating an IRS agent, or contact you by text, email or social media. The criminal calls or leaves a voicemail with a callback number claiming that you are linked to criminal activity. The scammer will harass you demanding you pay a bogus tax penalty.

Fraud Alerts - Walmart Tips to Help Avoid Gift Card Fraud. Walmart Gift Cards can only be used at Walmart stores or Sam’s Clubs in the U.S. or Puerto Rico, or on-line at Vudu, Inc., Walmart.com or Samsclub.com. No legitimate government entity, including the IRS, Treasury Department, FBI or local police department, will accept any form of gift cards as payment.

How to Recognize the IRS and Gift Card Scam - Hiya Learn what a real scam looks like to better protect yourself. In a text book IRS and gift card scam, a woman by the name of Sara was swindled out of $2,000. Here's her story. [dun dun] Sara received multiple calls from the same number in one day. When she first tried to call the number back, it was disconnected.

Gift Card Scam - YouTube Find out how to avoid becoming a victim of a gift card scam. For more information, go to . #IRS #ScamsFollow us:Twitter - ...

Report Gift Cards Used in a Scam | Federal Trade Commission Anyone who tells you to pay with a gift card is a scammer. Report gift cards used in a scam to the companies that issued the gift cards. Then, report it to the FTC at ftc.gov/complaint. Categories. Scam Watch. Transcript. Let's say someone calls and says he's from the IRS. He says you owe taxes and need to pay right away by getting a gift card ...

Fraud 101: What is the IRS Gift Card Scam? - Jax Federal Credit Union Once gift cards are purchased, the scammer will ask the victim to repeat the gift card numbers over the phone, at which time the scammer will spend the value of the gift card. The scam seems easy to spot and hard to believe, but Americans have been swindled out of nearly $40 million from this scam! How it Works. Scammers pose as IRS agents and ...

It’s the IRS calling…or is it? | Consumer Advice Mar 12, 2015 · Got a call and voice mail saying the IRS was filing a Lawsuit which is an obvious scam. The number they used this time was 509-252-0823 out of Spokane, WA. The IRS doesn't operate this way and will never call you about filing a lawsuit. Everything I have dealt with the IRS was first through the mail, never have they called me first.

Gift Card Scams: What They Are and How to Avoid Them In one common gift card scam, cybercriminals place a call or send a text message to the victim, claim to be a government agency or authority figure (such as the IRS, Social Security, the FBI or a ...

Publication 561 (01/2022), Determining the Value of Donated … Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

/cloudfront-us-east-1.images.arcpublishing.com/gray/YLSFNKW7DVEFTOYRORRNDV2C6E.PNG)

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/7290527/office.0.png)

/cloudfront-us-east-1.images.arcpublishing.com/gray/UPEUS6ZUJVGG3IRRVURSXV4KLQ.PNG)

0 Response to "45 irs gift card scam"

Post a Comment