43 gift card taxable income

U.S. Citizens and Resident Aliens Abroad | Internal Revenue … WebIf you are a U.S. citizen or resident alien, the rules for filing income, estate, and gift tax returns and paying estimated tax are generally the same whether you are in the United States or abroad. You are subject to tax on worldwide income from all sources and must report all taxable income and pay taxes according to the Internal Revenue Code. Instructions for Form 709 (2022) | Internal Revenue Service In 2011, A expended $2,400,000 of the applicable exclusion on the taxable gift to B. The second step of the procedure is to repeat the first step for every year where the donor made a taxable gift to a same-sex spouse. The third step of the procedure is to add up the result for all the years.

Personal Allowances: adjusted net income - GOV.UK Web13.08.2014 · Bill - income-related reduction to Personal Allowance, income over £100,000 For 2015 to 2016 Bill’s taxable income is £115,000, made up of: income from self-employment £85,000

Gift card taxable income

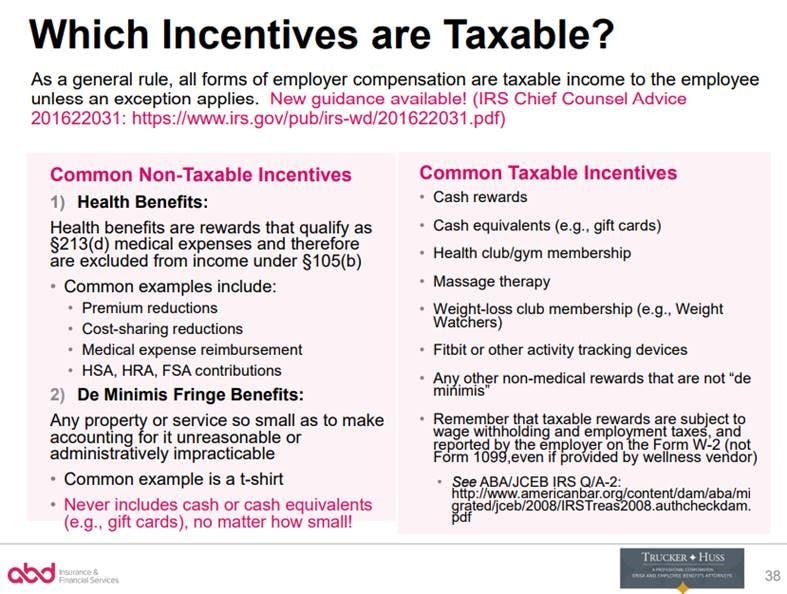

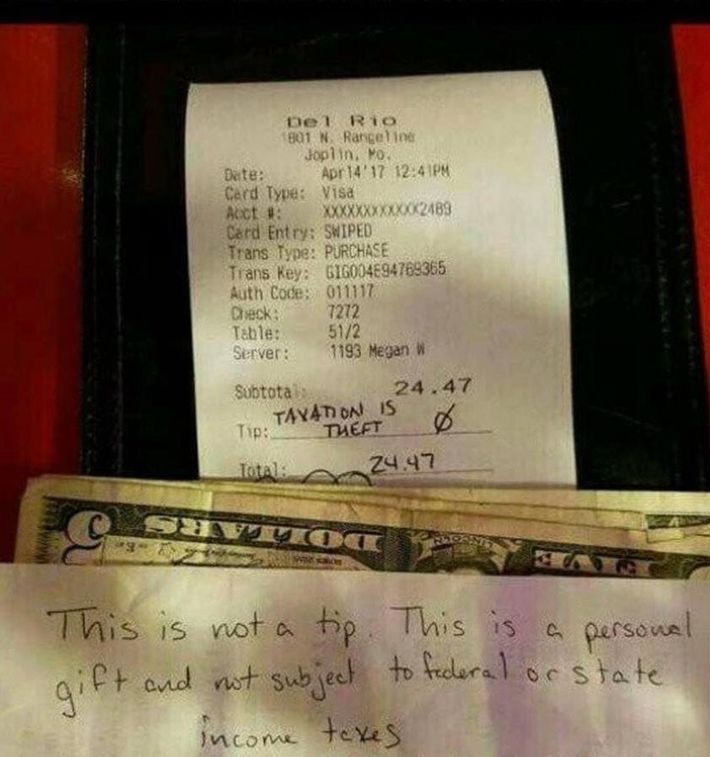

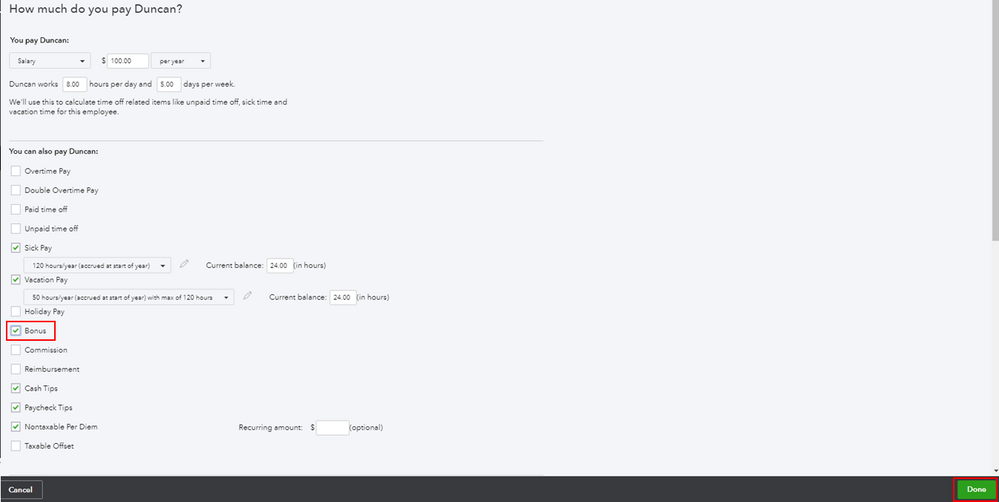

Taxation in the United States - Wikipedia WebTaxable income may differ from income for other purposes (such as for financial reporting). The definition of taxable income for federal purposes is used by many, but far from all states. Income and deductions are recognized under tax rules, and there are variations within the rules among the states. Book and tax income may differ. Income is divided … Frequently Asked Questions on Virtual Currency Transactions WebIn 2014, the IRS issued Notice 2014-21, 2014-16 I.R.B. 938 PDF, explaining that virtual currency is treated as property for Federal income tax purposes and providing examples of how longstanding tax principles applicable to transactions involving property apply to virtual currency. The frequently asked questions (“FAQs”) below expand upon the examples … Are Gift Cards Taxable? | Taxation, Examples, & More - Patriot … Web02.08.2022 · Let’s say you wanted to give an employee a $100 gift card for the holidays. You decide to use the percentage method for federal income tax. Follow these steps to determine how much to withhold from the gift card for taxes: First, multiply the gift card value by 22% to find the federal income tax: $100 X 0.22 = $22.00

Gift card taxable income. Charitable Contribution Deductions | Internal Revenue Service Web25.08.2022 · The amount of charitable contributions of food inventory a business taxpayer can deduct under this rule is limited to a percentage (usually 15 percent) of the taxpayer’s aggregate net income or taxable income. For contributions of food inventory in 2020, business taxpayers may deduct qualified contributions of up to 25 percent of their … Frequently Asked Questions on Gift Taxes - IRS tax forms Web27.10.2022 · Payment with extension, Form 8892, with credit card If you encounter problems making a payment using these codes, please call Federal Tax Collection Service (Same-Day Wire) Customer Service at 800-382-0045 or 314-425-1810 between 8:30 a.m. to 7 p.m. Eastern Time, Monday through Friday. Gift Tax | Internal Revenue Service - IRS tax forms WebThe gift tax applies to the transfer by gift of any type of property. You make a gift if you give property (including money), or the use of or income from property, without expecting to receive something of at least equal value in return. If you sell something at less than its full value or if you make an interest-free or reduced-interest loan, you may be making a gift. What Is Taxable Income and How to Calculate It - Forbes Advisor Oct 28, 2022 · Taxable income is the amount of your income that’s subject to tax, after taking advantage of available exclusions, adjustments, and deductions. ... Credit Card Reviews ... only the gift is non ...

Publication 525 (2021), Taxable and Nontaxable Income WebGross income doesn’t include any amount arising from the forgiveness of a Paycheck Protection Program (PPP) loan, effective for taxable years ending after 3/27/2020. (See P.L. 116-136.) Likewise, gross income does not include any amount arising from the forgiveness of Second Draw PPP loans, effective 12/27/2020. (See P.L. 116-260.) What Types of Income Aren't Taxable? | GOBankingRates Oct 22, 2022 · However, what’s less commonly known is that there are seven bonafide types of income that are non-taxable. You don’t need to be a CPA to keep these earnings tax free. Here’s a handy-dandy review of all the non-taxable incomes you might qualify for. Find: This Credit Score Mistake Could Be Costing Millions of Americans Are Gift Cards Taxable? | Taxation, Examples, & More - Patriot … Web02.08.2022 · Let’s say you wanted to give an employee a $100 gift card for the holidays. You decide to use the percentage method for federal income tax. Follow these steps to determine how much to withhold from the gift card for taxes: First, multiply the gift card value by 22% to find the federal income tax: $100 X 0.22 = $22.00 Frequently Asked Questions on Virtual Currency Transactions WebIn 2014, the IRS issued Notice 2014-21, 2014-16 I.R.B. 938 PDF, explaining that virtual currency is treated as property for Federal income tax purposes and providing examples of how longstanding tax principles applicable to transactions involving property apply to virtual currency. The frequently asked questions (“FAQs”) below expand upon the examples …

Taxation in the United States - Wikipedia WebTaxable income may differ from income for other purposes (such as for financial reporting). The definition of taxable income for federal purposes is used by many, but far from all states. Income and deductions are recognized under tax rules, and there are variations within the rules among the states. Book and tax income may differ. Income is divided …

:max_bytes(150000):strip_icc()/TaxableIncome_Version1_4188122-635a1cf2f69a48f5bdcc697eb075b5a4.png)

0 Response to "43 gift card taxable income"

Post a Comment