40 tax refund gift card bonus

Selkirk BizBucks: Supporting Local, Celebrating Success It took almost three years of research and discovery to identify our needs and find EML Payments gift card program, but Skalesky says it was well worth the efforts. "We quietly launched in December 2018, in the middle of the holiday season, and sold $13,000 in gift cards. In 2019, we sold $158,000 and the redemption rate has been great, which ... Property Tax - City of Selkirk REMEMBER: Property & business tax bill payments are due July 29, 2022. Taxes received after this time will be assessed late penalties of 1.25% per month on the first day of each month until paid in full. Current taxes are payable, at par, on or before the last working day in July of the current year.

Gift card as a tax refund: a good idea? - CSMonitor.com TurboTax has an offer embedded in it that will give you an Amazon.com gift card in lieu of your tax return. If you accept that, they'll add an additional 5% to the balance of that card....

Tax refund gift card bonus

Frank's Pizza Gift Card - Selkirk, MB | Giftly Buying a Frank's Pizza gift on Giftly is a great way to send money with a suggestion to use it at this restaurant. Like a Frank's Pizza gift card, a Giftly for Frank's Pizza is a versatile present that can be used for any purchase, but without the risk of a leftover gift card balance. You can buy a Giftly gift online for Frank's Pizza. Are Gift Cards Taxable? | Taxation, Examples, & More - Patriot Software Follow these steps to determine how much to withhold from the gift card for taxes: First, multiply the gift card value by 22% to find the federal income tax: $100 X 0.22 = $22.00 Now, multiply the gift card value by 6.2% to find the Social Security tax (unless the employee has reached the Social Security wage base ): $100 X 0.062 = $6.20

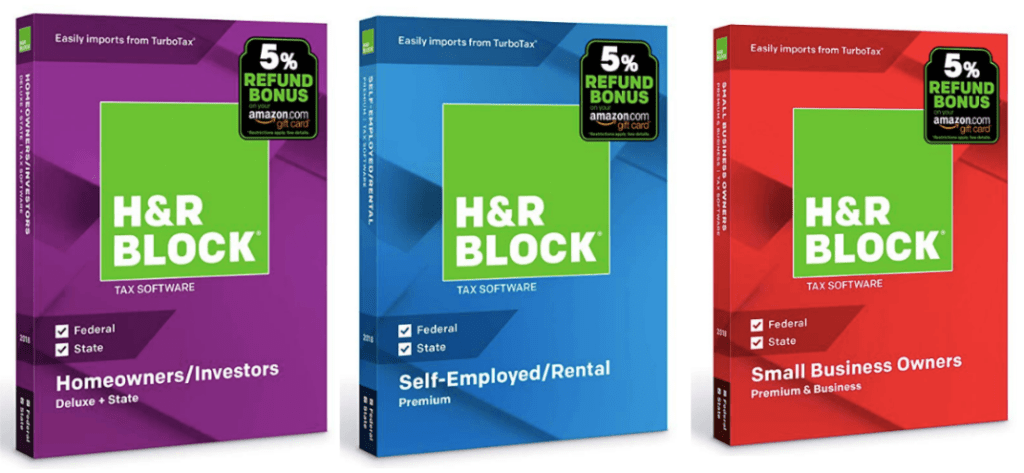

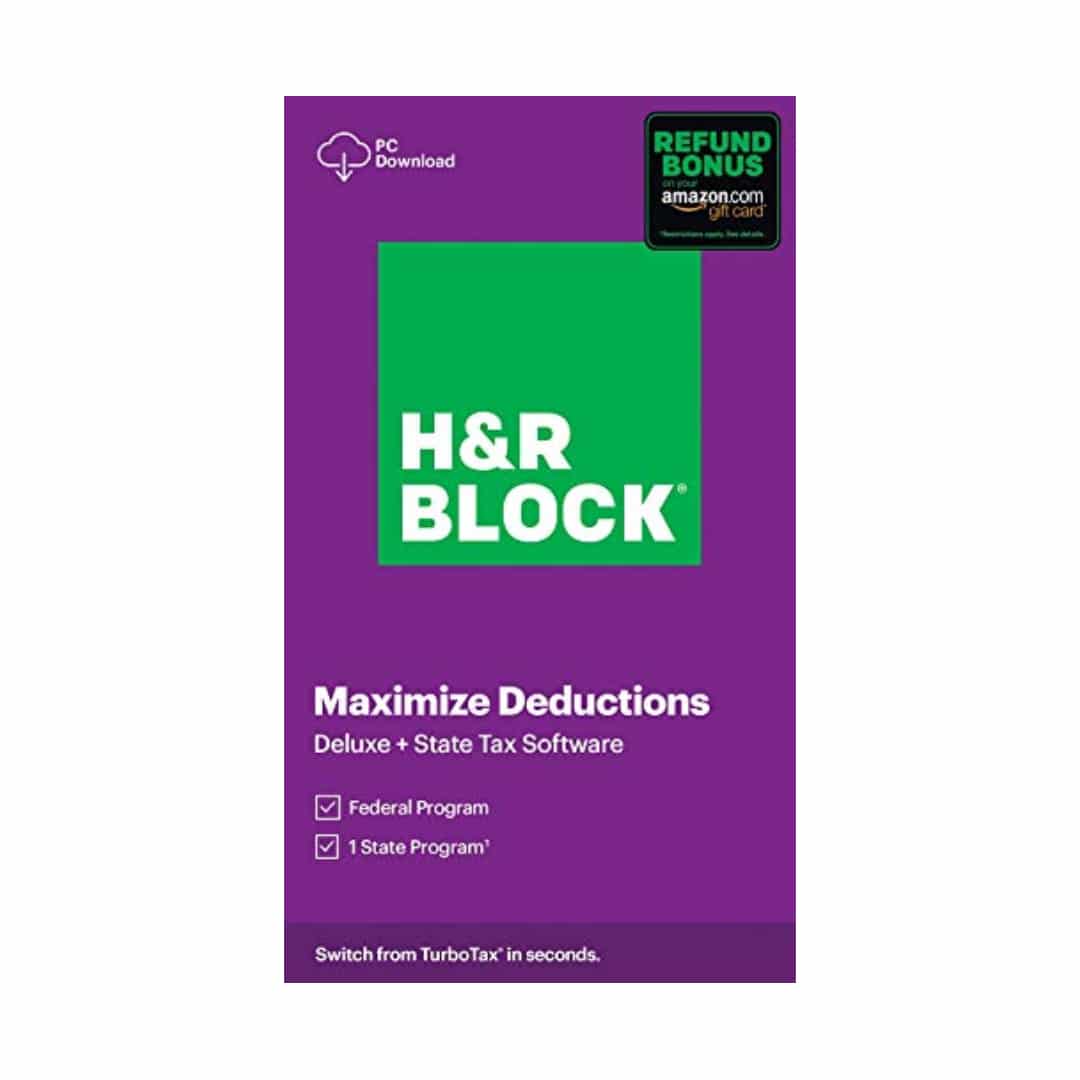

Tax refund gift card bonus. Bonus Tax Rate | H&R Block If the bonus is paid or identified separately, it can be taxed at a flat rate of 22%. Either way, the paying of the supplemental wages will affect your tax withholding for that period, so be prepared. Tax on a Bonus Exceeding $1 Million Any excess wages over $1 million will be taxed at a rate of 37%. Tax Reporting of Bonuses - Where Do You Start? Bonus Tax Rate | H&R Block If the bonus is paid or identified separately, it can be taxed at a flat rate of 22%. Either way, the paying of the supplemental wages will affect your tax withholding for that period, so be prepared. Tax on a Bonus Exceeding $1 Million Any excess wages over $1 million will be taxed at a rate of 37%. Tax Reporting of Bonuses - Where Do You Start? Get Up To 10% Bonus On Tax Refund With TurboTax And Amazon Let's say you get a $2,000 refund and put it on the Amazon gift card, that's up to an extra $200 free, or a $2,200 gift card! Here's what you do to get the deal Go here to order TurboTax Ships Free with Amazon Prime. You can get a free 30 day trial! PDF Refund Bonus - Tax Preparation Services Company | H&R Block® reduced amount. If no refund is sent, you will not be able to purchase a Gift Card and you will not receive a refund bonus. 8. When your federal income tax refund has been sent by the IRS, H&R Block will email you a link for you to access your Gift Card redemption code. Gift Cards are subject to a maximum amount of $2,000.

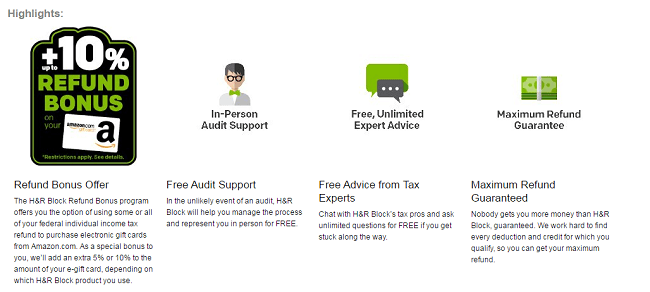

TurboTax: 10% Bonus on Amazon Gift Card Bought w/ Your Tax Refund TurboTax and Amazon.com Bonus Promotion: Use Part of Your federal tax refund to Buy an Amazon.com Gift Card, & TurboTax will give you a 5-10% bonus on top of the value that you buy! (Example: Buy a $1000 gift card, TurboTax will add $100 to the value) *TurboTax no longer offers the Amazon gift card for your refund: H&R Block Offers 4% Tax Refund Bonus On Amazon Gift Cards - SharonDerd How To Return Products and Get Refunds on Gift Card Balances How To Transfer Credit From Your Gift Card to the Original Form of Payment Process a refund to a gift card Step 1 : Navigate to the Refund Invoice window Step 2: Select items: Step 3: Select payment method: Step 4: Generate an invoice: People Also Search Don't Get Your Tax Refund on an Amazon Gift Card - Lifehacker as americans get ready do their taxes ahead of the april 15 deadline, the tax preparer that handles more than 20 million returns each year has a special offer for the do-it-yourself filers who... H&R Block Offers Tax Refund Bonus on Amazon.com eGift Card (2018) H&R Block Amazon.com discount plus refund bonus. Put part or all of your federal tax refund towards an e-gift card for Amazon.com and get a 5% bonus from Amazon. Bonus available when you e-file with an H&R Block software download product. (2018)

H&R Block Offers 4% Tax Refund Bonus On Amazon Gift Cards - Money as americans get ready do their taxes ahead of the april 15 deadline, the tax preparer that handles more than 20 million returns each year has a special offer for the do-it-yourself filers who use its software: opt to get all or part ( anywhere from $100 to $9,000) of your federal refund in the form of an amazon gift card instead of cash, and … H&R Block Tax Refund Promotion: Earn Up to 10% Amazon Gift Card Bonus What To Do: Purchase H&R Block Tax Software Deluxe and opt to receive your refund in a form of a amazon gift card Terms: There is a 10% bonus was for Deluxe and Premium plans, while the Basic plan gets 5%. Limit of a $900 Gift Card bonus. Get H&R Block Amazon Bonus: Purchase the H&R Block Tax Software Deluxe File your taxes with H&R Block Must-Know Tax Rules for Employee Gift Cards: 2022 Update - Giftogram To save on the tax dollars associated with employee gifts, you can opt to build gift card taxes into employee's salary using this simple formula: Face Value of the Gift Card x Tax Percentage/1-Tax Percentage. 3 Big Benefits of Giftogram Gift Cards for Employees and Customers Manage Gift Card Transactions with Giftogram's Reporting Tools H&R BLOCK Refund eGift Card Bonus Program - Hustler Money Blog 1 HR BLOCK Refund eGift Card Bonus Program: 2 Maximize H&R BLOCK Refund Gift Card Bonus: 3 Bottom Line: HR BLOCK Refund eGift Card Bonus Program: Sign Up Now Promotion: Get 5% to 10% on top of your tax return refund amount from H&R BLOCK when you use their software to e-file your taxes online, depending on which edition you use.

Bonus Tax Rate 2022: How Are Bonuses Taxed and Who Pays? Your total bonuses for the year get taxed at a 22% flat rate if they're under $1 million. If your total bonuses are higher than $1 million, the first $1 million gets taxed at 22%, and every...

Are Gift Cards Taxable? | Taxation, Examples, & More - Patriot Software Follow these steps to determine how much to withhold from the gift card for taxes: First, multiply the gift card value by 22% to find the federal income tax: $100 X 0.22 = $22.00 Now, multiply the gift card value by 6.2% to find the Social Security tax (unless the employee has reached the Social Security wage base ): $100 X 0.062 = $6.20

Frank's Pizza Gift Card - Selkirk, MB | Giftly Buying a Frank's Pizza gift on Giftly is a great way to send money with a suggestion to use it at this restaurant. Like a Frank's Pizza gift card, a Giftly for Frank's Pizza is a versatile present that can be used for any purchase, but without the risk of a leftover gift card balance. You can buy a Giftly gift online for Frank's Pizza.

![H&R Block Tax Software Deluxe + State 2022 with Refund Bonus Offer (Amazon Exclusive) [Physical Code by Mail]](https://m.media-amazon.com/images/I/41ToIsNvboL._AC_SY1000_.jpg)

H&R Block Tax Software Deluxe + State 2022 with Refund Bonus Offer (Amazon Exclusive) [Physical Code by Mail]

![Southwest Gift Cards, Travel Funds & LUV Vouchers [2022 Update]](https://upgradedpoints.com/wp-content/uploads/2022/07/How-to-use-Southwest-gift-cards-online.png)

![H&R Block Tax Software Basic 2020 with 3.5% Refund Bonus Offer (Amazon Exclusive) [PC Download] [Old Version]](https://m.media-amazon.com/images/I/41wWOUmnHtL._AC_SY1000_.jpg)

0 Response to "40 tax refund gift card bonus"

Post a Comment