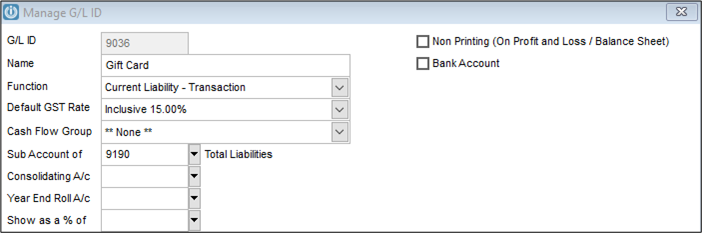

40 gst on gift card

› payback › flipkart-gift-vouchersRedeem Payback Points & Get Flipkart Gift Card Free - GYFTR Flipkart Gift Vouchers & Gift Card Deals Established in 2007, Flipkart is your portal to the world of online shopping. This online retail store houses everything a customer wants-ranging from essential products to home appliances to home decor ; from trendy clothing & accessories to smartphones & laptops, you can simply find anything & everything. Gift Card - Buy Gift Cards, Visa Gift Card - ICICI Bank Tax & GST; NEFT. Transfer money to any other bank account with Internet Banking or mobile app. IMPS. Transfer funds instantly, 24X7 (including holidays) with IMPS ... If you are a corporate customer, you may avail the Gift Card by contacting your Relationship Manager or SMS GCOFFER to 5676766. T&C apply.

Confusion over GST levy on Gift Vouchers and Gift Cards cleared Confusion over GST levy on Gift Vouchers and Gift Cards cleared. With the advent of new types of securities, new technologies and new ways of keeping money, the tax system has to constantly evolve in order to keep up. One of these new trends, especially in the fashion and food industry is that of pre-paid instruments (PPIs), commonly known as ...

Gst on gift card

Gift Cards - Apple (NZ) Apple Store Gift Cards may only be used for purchases in New Zealand at the Apple Online Store or by calling 0800-692-7753.Apple Gift Cards cannot used for purchases at or for: iTunes, the App Store, the Mac App Store, the iBooks Store, additional Apple Gift Cards, payment to any account of any mobile phone contracts or service plans, purchases at Apple resellers, or any … Gift Tax, Explained: 2022 and 2021 Exemption and Rates Using the above rates and brackets, the first $10,000 of this hypothetical gift would be taxed at 18%, the next $10,000 at 20% and the remaining $14,000 ($15,000 in 2021) would be subject to a 22% rate. IGA Supermarkets Gift Card - Metcash Gift Cards Gift cards are just the thing for birthdays, Christmas or just to say thank you. With an IGA Gift Card, purchases can be made at IGA stores throughout Australia. $ 10.00 – $ 250.00

Gst on gift card. Where Can I Buy Costco Gift Cards? - The Superficial Costco is one such retailer that offer gift cards like many others. They offer gift cards in the denominations ranging from $25 to $1000. The wide range of merchandise they sell makes it a good option for buying their gift card. You can also buy alcohol at Costco's stores and warehouses. GST Admit Card Download 2022 - gstadmission.ac.bd GST Admit Card Download. The Admit Card Download Date has been Rescheduled. Candidates who are unable to download the Admit Card within the published timeframe, they can still download it until before 2 hours of the Admission Test for each unit. Unit-A, Unit-B, and Unit-C Admit Cards have been published together. Download GST Admit Card 2022 Gift, Estate, and GST Tax Exclusion and Exemption Amounts: The Numbers ... The IRS also announced the annual inflation adjustment for the federal gift, estate, and GST tax exemption, which increases the amount sheltered from taxes from $11,700,000 for 2021 to $12,060,000 ... GST - GST changes on cards - Telegraph India Fitment panel. Major changes proposed by the officers' panel or the fitment committee in the tax rates are a uniform 5 per cent GST rate on prostheses (arti-ficial limbs) and orthopaedic implants (trauma, spine, andarthoplasty implants).Besides, or thoses (splints,braces, belts and calipers) too have been proposed in the lowest bracket of 5 ...

Are Gift Cards Taxable? | Taxation, Examples, & More - Patriot Software Follow these steps to determine how much to withhold from the gift card for taxes: First, multiply the gift card value by 22% to find the federal income tax: $100 X 0.22 = $22.00. Now, multiply the gift card value by 6.2% to find the Social Security tax (unless the employee has reached the Social Security wage base): $100 X 0.062 = $6.20 The Good Guys: 12% Cashback (Was 3%, Uncapped, Gift Card … 16/09/2022 · Spotted the banner on the CR website.. 12% Cashback at The Good Guys that's Uncapped between 12:00pm - 11:59pm! Probably the last ever time Gift Card redemption is allowed with a deal like this!. Important update: Effective 01/10/22, cashback will be ineligible on any amount paid with gift cards. GST Admit Card Download 2022 | BDinquiry.com - Information Hub The date for the GST Admission Test has been introduced. The admission take a look at will happen from October 16, 2022. Those of you who've been nominated for the written admission take a look at ought to download the admission card quickly. Each pupil should download the admission card to take part within the admission take a look at. Automatic Cashback | In-Store & Online | Cashrewards You may not earn Cashback on GST, freight, delivery fees and taxes. You won’t earn Cashback if an order is cancelled, changed or returned. ... For queries regarding the purchase of your Digital Gift Card, contact True Rewards on 1800 850 739 Mon-Fri …

GST on Cars/Four-Wheelers in 2022 [Tax Rates, HSN Codes] VAT and Excise were the two taxes that the end consumer of cars had to pay previously. This was with an average combined rate ranging from 26.50% to 44%. This certainly exceeds the rates of 18% and 28% under GST. Consequently, there has been a reduction of the financial pressure of tax on the end consumer, thanks to GST. › choice-gift-cardAutomatic Cashback | In-Store & Online | Cashrewards Review all terms & conditions of this Digital Gift Card prior to finalising your order. Terms are set by each retailer (not Cashrewards). For queries regarding the purchase of your Digital Gift Card, contact True Rewards on 1800 850 739 Mon-Fri 9am-5pm Syd time (excluding public holidays), or email help@truerewards.com.au Decriminalising certain offences under GST on cards 966. New Delhi, September 28. The government is working on decriminalisation of certain offences under GST by raising the threshold limit for launching prosecution and also lowering charges for ... Gifts, awards and social events - Canada.ca Services and information. Gifts, awards and long-service awards. Rules and policy for gifts and awards. Information on the long-service or anniversary award. Gifts and awards outside our policy. Cash or near-cash gifts, hospitality rewards, manufacturer-provided gifts, and some other gifts and awards are always taxable.

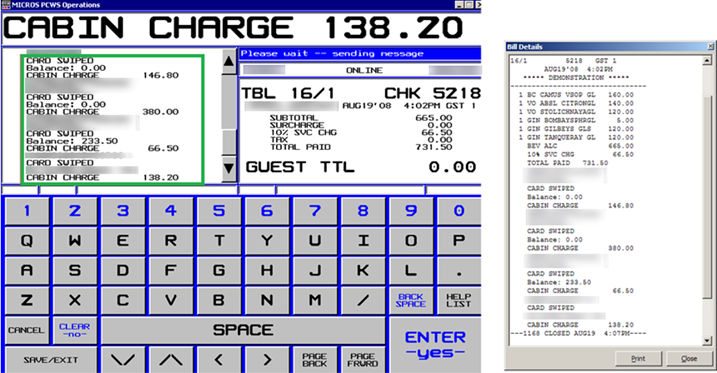

Can GST Be Paid By Using A Credit Card? - IIM SKILLS The short answer is Yes! Individuals and entities can pay GST using online platforms such as debit or credit cards. The government rolled out the new indirect tax regime in 2016 and made restrictions, refunds, and return filing online. Not only can you pay by credit card or debit card, but also by using many methods such as NEFT, RTGS, etc.

GST Incorrectly Attracted to Free Gift Cards in Shopify Reports ... Hello, Currently the way our store is we can have the following occur: A $110 gift card is created for FREE A $110 product is purchased with this gift card $10 is attributed to tax (gst) and $100 is attributed to net sales No money is added to the payout (clearly) This seems quite wrong, can some...

How to generate Form 709, Gift Tax Return in Lacerte - Intuit Follow these instructions to generate Form 709: Add a new client file. In Screen 1, Client Information, enter the Taxpayer Information. Complete the Spouse Information if applicable. If gift splitting, mark the box Gift Splitting. If the spouse will file Form 709, select the box Will File Form 709 . This will generate a spouse's Form 709 on the ...

GST: Representation seeking clarification on taxability of gift cards ... No GST payable on buying and selling of vouchers. a) Interpretation adopted by AAAR is against established legal provisions. Under the pre-GST era as well, gift cards / vouchers were taxed at the time of their redemption with the rate of tax being applied basis the goods/ services supplied against the voucher.

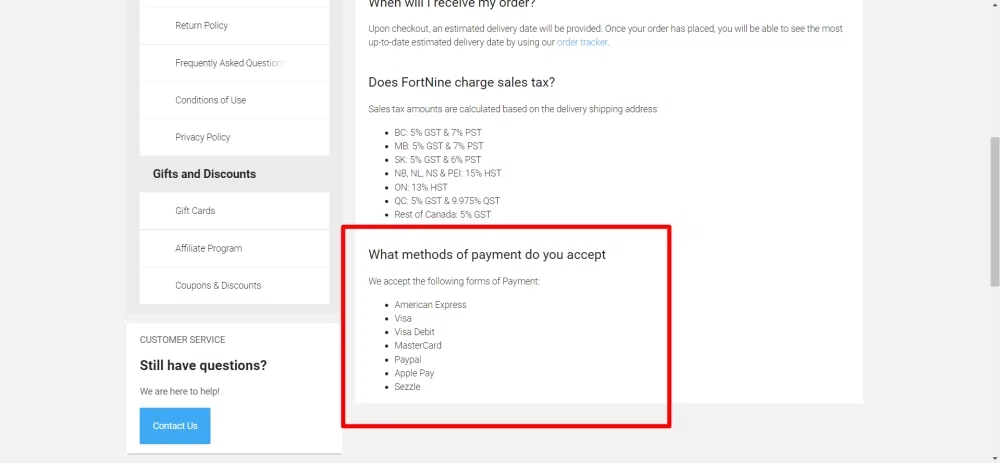

bostonpizza.com › en › gift-cardsGift Cards | Boston Pizza Guests receive 10% back in bonus gift cards when spending $1000 or more on their gift card purchase. *A valid HST/GST number is required when purchasing bulk gift cards using our online portal.

Transactions of Sale Vouchers - Applicability of Gst The Authority for Advance Ruling ruled as detailed below-. The supply of vouchers is taxable and the time of supply in all three cases would be governed by Section 12 (5) of the CGST Act, 2017. The rate of tax on the supply of vouchers is 18% GST as per entry no. 453 of Schedule III of Notification No. 01/2017-Central Tax (R) dated 28.06.2017.

› Personal-Banking › cardsGift Card - Buy Gift Cards, Visa Gift Card - ICICI Bank Load the Gift Card with the gift amount** to activate it instantly; Give the Gift Card to your recipient; The recipient generates a PIN by calling the Customer Care on 022-50405238; Use the Gift Card by entering the PIN at any VISA enabled merchant establishment across India. The recipient can also redeem the Gift Card online.

Guccho / GST Admit Card Download 2022 - Admissionwar.com GST Seat Plan of the test will be informed via SMS later and will be published on the website. Guccho Admit Card 2022. First, you have to visit the official website of GST. The GST official website is gstadmission.ac.bd. You will see an option called "GST Admit Card" on the page displayed on the screen. Click on that option.

metcashgiftcards.com.au › product › iga-supermarketsIGA Supermarkets Gift Card - Metcash Gift Cards Gift cards are just the thing for birthdays, Christmas or just to say thank you. With an IGA Gift Card, purchases can be made at IGA stores throughout Australia. $ 10.00 – $ 250.00

The 21 Best Gift Cards of 2022 - The Spruce Being a plant parent has become quite trendy, and The Sill is a popular retailer for all plant needs. Gift cards start at $25, and the recipient can apply those funds to a new plant, bouquet, plant accessories, or subscription. New plant parents will find the easy-to-follow instructions practical and intimidation-free.

10 Ways to Convert a Visa Gift Card to Cash - Well Kept Wallet 3. Buy Other Gift Cards. A more indirect way to convert your Visa gift card to cash is to buy a different gift card. If you know you'll use a company-branded gift card, it can be more valuable to you than one from Visa. For example, you could use your Visa gift card to buy an Amazon gift card of equal value.

› nz › shopGift Cards - Apple (NZ) Apple Store Gift Cards may only be used for purchases in New Zealand at the Apple Online Store or by calling 0800-692-7753.Apple Gift Cards cannot used for purchases at or for: iTunes, the App Store, the Mac App Store, the iBooks Store, additional Apple Gift Cards, payment to any account of any mobile phone contracts or service plans, purchases at Apple resellers, or any payment due under an ...

Go Gift Card (Balance, Activation, and More) Here's how to check your Go Gift Card balance: First, visit the Go Gift Card home page here. Next, enter your card information in the Manage Your Card section as shown in the image below. Once you have entered the card information, click on the "Check Balance" to view your card balance. Also, you can check your Go Gift Card balance by ...

› node › 725012The Good Guys: 12% Cashback (Was 3%, Uncapped, Gift Card ... Sep 16, 2022 · Alternatively, have a look at various discounted gift card portals to see whether you can purchase a TGG gift card at an admittedly small discount. Alternatively again, you can purchase a TGG gift card from Prezzee or via True Rewards without any discount to cover the difference between the Dyson and the Ultimate Home gift card balance.

IGA Supermarkets Gift Card - Metcash Gift Cards Gift cards are just the thing for birthdays, Christmas or just to say thank you. With an IGA Gift Card, purchases can be made at IGA stores throughout Australia. $ 10.00 – $ 250.00

Gift Tax, Explained: 2022 and 2021 Exemption and Rates Using the above rates and brackets, the first $10,000 of this hypothetical gift would be taxed at 18%, the next $10,000 at 20% and the remaining $14,000 ($15,000 in 2021) would be subject to a 22% rate.

Gift Cards - Apple (NZ) Apple Store Gift Cards may only be used for purchases in New Zealand at the Apple Online Store or by calling 0800-692-7753.Apple Gift Cards cannot used for purchases at or for: iTunes, the App Store, the Mac App Store, the iBooks Store, additional Apple Gift Cards, payment to any account of any mobile phone contracts or service plans, purchases at Apple resellers, or any …

/cdn.vox-cdn.com/uploads/chorus_asset/file/13632076/IMG_7116.jpg)

0 Response to "40 gst on gift card"

Post a Comment